UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 3, 2022

(Exact Name of Registrant as Specified in its Charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||

(Address of principal executive offices) (Zip Code)

(650 ) 584-2700

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. | |||||||

On May 3, 2022, eHealth, Inc. (the “Company”) issued a press release announcing its financial results for the first quarter ended March 31, 2022. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On May 3, 2022, the Company posted supplemental investor material on its investor relations webpage at

http://ir.ehealthinsurance.com. The Company intends to use its investor relations webpage as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. A copy of the supplemental investor materials is also furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

http://ir.ehealthinsurance.com. The Company intends to use its investor relations webpage as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. A copy of the supplemental investor materials is also furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K and the exhibits attached hereto are intended to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. Except as shall be expressly set forth by specific reference in such filing, the information contained herein and in the accompanying exhibits shall not be incorporated by reference into any filing with the Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| Item 9.01 | Financial Statements and Exhibits. | |||||||

(d) Exhibits

| Exhibit No. | Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| eHealth, Inc. | ||||||||

| Date: | May 3, 2022 | /s/ Christine Janofsky | ||||||

Christine Janofsky Chief Financial Officer (Principal Financial Officer) | ||||||||

eHealth, Inc. Announces First Quarter 2022 Results

SANTA CLARA, California — May 3, 2022 — eHealth, Inc. (Nasdaq: EHTH), a leading private online health insurance marketplace, today announced its financial results for the first quarter ended March 31, 2022.

First Quarter 2022 Overview | |||||||||||||||||||||||

| $105.3M | $(32.7)M | $(24.8)M | |||||||||||||||||||||

| TOTAL REVENUE | GAAP NET LOSS | ADJUSTED EBITDA (1) | |||||||||||||||||||||

| $47.1M | +50% | YoY | $831.2M | ||||||||||||||||||||

| OPERATING CASH FLOW | MEDICARE ADVANTAGE APPLICATIONS SUBMITTED ONLINE UNASSISTED | COMMISSIONS RECEIVABLE BALANCE | |||||||||||||||||||||

| First Quarter 2022 Highlights | ||||||||

•First quarter financial results reflected the impact of our enrollment quality initiatives on telephonic conversion rates and intentional deceleration of our telephonic enrollment in 2022 as we focus on returning to profitable growth. •Enrollment quality initiatives resulted in substantial improvement in retention rates and quality scores for the fourth quarter 2021 Medicare Advantage enrollments, based on preliminary data. •Online business continues to scale with 50% year-over-year increase in online unassisted Medicare Advantage enrollments. •Total revenue for the first quarter of 2022 was $105.3 million, a 22% decrease compared to $134.2 million for the first quarter of 2021. •Cash flow from operations of $47.1 million. •As of March 31, 2022, we had $232 million in cash, cash equivalents and marketable securities. •Estimated Medicare Advantage membership and total Medicare membership as of March 31, 2022 grew 9% and 4%, respectively, compared to March 31, 2021. | ||||||||

| CEO Comments | ||||||||

We delivered first quarter results with revenue in-line and adjusted EBITDA ahead of our expectations driven by the early impact of cost transformation initiatives. As part of our commitment to returning the company to profitable growth, we are currently on track to generate approximately $60 million in annualized cost savings this year. In line with our strategic plan, we are slowing down our conventional telephonic enrollment growth while continuing to invest for expansion and market share capture in our online business. Providing excellent service and leveraging our platform to match customers with optimal coverage based on their specific needs is at the center of our strategy. The initial traction we are seeing through the early part of fiscal 2022 in terms of retention and quality scores combined with positive carrier feedback reinforces our belief that eHealth can establish itself as a leader in Medicare distribution as this market moves away from volume at-all-costs and toward growth built on a foundation of enrollment quality, enhanced consumer experience and cash flow generation. | ||||||||

_____________

(1)See the Non-GAAP Financial Information section for definitions of our non-GAAP financial measures.

1

GAAP — First Quarter of 2022 Results

| (In thousands, except per share amounts) | Q1 2022 | Q1 2021 | |||||||||

| Total revenue | $ | 105,250 | $ | 134,214 | |||||||

| Total commission revenue | 93,850 | 127,052 | |||||||||

| Segment revenue | |||||||||||

| Medicare | 95,067 | 121,021 | |||||||||

| Individual, Family and Small Business | 10,183 | 13,193 | |||||||||

| Segment profit (loss) | |||||||||||

| Medicare | (14,817) | 24,545 | |||||||||

| Individual, Family and Small Business | 5,254 | 8,052 | |||||||||

| Loss from operations | (39,714) | (642) | |||||||||

| Net loss | (32,742) | (800) | |||||||||

| Net loss attributable to common stockholders | (39,960) | (800) | |||||||||

| Diluted net loss attributable to common stockholders per share | (1.46) | (0.03) | |||||||||

| Net cash provided by operating activities | 47,112 | 42,809 | |||||||||

Total commission revenue for the three months ended March 31, 2022 decreased 26% compared to the same period in 2021 due to a $27.8 million decrease in Medicare segment commission revenue and a $3.0 million decrease in commission revenue from the Individual, Family and Small Business segment.

The decrease in commission revenue from the Medicare segment was driven by a 22% decrease in Medicare plan approved members. This was caused primarily by a 23% decline in Medicare Advantage plan approved members compared to 2021 and due to lower telephonic conversion rates.

The decrease in commission revenue from the Individual, Family and Small Business segment was primarily due to a 32% decrease in short-term ancillary plan approved members, a 31% decrease in dental plan approved members, a 13% decrease in individual and family major medical plan approved members and a $2.8 million decrease in net adjustment revenue.

Other revenue increased $4.2 million, or 59%, during the three months ended March 31, 2022 compared to the same period in 2021 due to an increase in Medicare advertising revenue.

2

Non-GAAP(1) — First Quarter 2022 Results

| (In thousands, except per share amounts) | Q1 2022 | Q1 2021 | |||||||||

| Non-GAAP net income (loss) | $ | (24,923) | $ | 9,383 | |||||||

| Non-GAAP net income (loss) per diluted share | (0.91) | 0.36 | |||||||||

| Adjusted EBITDA | (24,828) | 17,311 | |||||||||

_____________

(1)See Non-GAAP Financial Information for definitions of our non-GAAP financial measures.

Non-GAAP net loss for the first quarter of 2022 was $24.9 million, or $0.91 non-GAAP net loss per diluted share, compared to non-GAAP net income of $9.4 million, or $0.36 non-GAAP net income per diluted share, for the same period in 2021, primarily attributable to a decrease in total revenue and a 12% increase in non-GAAP operating expense primarily as a result of our enrollment quality initiatives.

Non-GAAP net loss and non-GAAP net loss per diluted share for the first quarter of 2022 were calculated by excluding $4.7 million of paid-in-kind dividends, $2.5 million change in preferred stock redemption value, $5.3 million of stock-based compensation expense, $4.8 million of restructuring and reorganization charges, and $2.3 million of the income tax effect of these non-GAAP adjustments from GAAP net loss attributable to common stockholders and GAAP net loss attributable to common stockholders per diluted share.

Non-GAAP net income and non-GAAP net income per diluted share for the first quarter of 2021 were calculated by excluding $11.4 million of stock-based compensation expense, $2.4 million restructuring charges, $0.2 million of amortization of intangible assets and $3.8 million of the income tax effect of these non-GAAP adjustments from GAAP net loss attributable to common stockholders and GAAP net loss attributable to common stockholders per diluted share.

Adjusted EBITDA for the first quarter of 2022 decreased compared to the same period in 2021 primarily due to a decrease in total revenue, an increase in non-GAAP operating expense, including an increase in customer care and enrollment costs primarily as a result of employing more internal agents in 2022. Non-GAAP operating expense was also impacted by an increase in variable marketing expense.

3

Selected Metrics Highlights — First Quarter of 2022 Results

| Q1 2022 | Q1 2021 | ||||||||||

| Approved Members | |||||||||||

| Medicare | 95,810 | 122,677 | |||||||||

| Individual and Family | 9,801 | 11,314 | |||||||||

| New Paying Members | |||||||||||

| Medicare | 152,089 | 180,132 | |||||||||

| Individual and Family | 16,230 | 17,607 | |||||||||

Estimated Membership(3) | 1,287,640 | 1,263,507 | |||||||||

Online Submission %(1) – Major Medicare(2) | 47 | % | 35 | % | |||||||

Unassisted Online Submission % – Major Medicare(2) | 12 | % | 6 | % | |||||||

_____________

(1)Online submission % represents a combination of unassisted and partially agent-assisted online applications.

(2)Major Medicare plans include Medicare Advantage and Medicare Supplement plans.

(3)As of March 31, 2022.

Medicare approved members decreased 22% in the first quarter of 2022 compared to the first quarter of 2021, due to a decrease in Medicare plan members. The decrease in Medicare plan members was driven by lower submitted applications primarily due to lower telephonic conversion rates and our decision to reduce our investment in telephonic enrollment growth in 2022. Approved members for individual and family plan major medical products decreased 13% in the first quarter of 2022 compared to the first quarter of 2021, due to a decrease in enrollments in both qualified and non-qualified individual and family plans.

Medicare new paying members decreased 16% in the first quarter of 2022 compared to the first quarter of 2021, due primarily to a decline in Medicare products approved members. Individual and family plan new paying members decreased 8% in the first quarter of 2022 compared to the first quarter of 2021, due primarily to a decline in approved members for non-qualified and qualified plans.

Estimated membership was 1,287,640 at the end of the first quarter of 2022, an increase of 2% compared to estimated membership at the end of the first quarter of 2021, primarily driven by a 4% increase in Medicare estimated membership including an 9% increase in Medicare Advantage estimated membership.

As our online business continued to scale, the number of first quarter 2022 Major Medicare applications submitted online unassisted grew 47% compared to the first quarter of 2021 primarily driven by enhanced user experience and favorable conversion rates on our ecommerce platform. Our unassisted online application submissions represented 12% of Major Medicare applications in the first quarter of 2022 compared to 6% in the same quarter in 2021.

Convertible Preferred Stock

On April 30, 2021, we issued and sold 2.25 million shares of Series A Preferred Stock, par value $0.001 per share, at an aggregate purchase price of $225.0 million to an investment vehicle of H.I.G. Capital in a private placement. This transaction resulted in net proceeds of $214.0 million.

During the first quarter of 2022, we accrued paid-in-kind dividends on the Series A Preferred Stock at 8% per annum equal to $4.7 million and recognized $2.5 million of accretion due to the redemption feature available to H.I.G. Capital at the sixth anniversary of the closing of this transaction. These charges were recorded as a reduction of our retained earnings and had no impact on GAAP net loss, which was $32.7 million, for the first quarter of 2022. However, as the Series A Preferred Stock is considered a participating security, both of these charges impacted net loss attributable to common stockholders and net loss attributable to common stockholders per share. For the first quarter of 2022, GAAP net loss attributable to common stockholders was $40.0 million, or $1.46 per share.

4

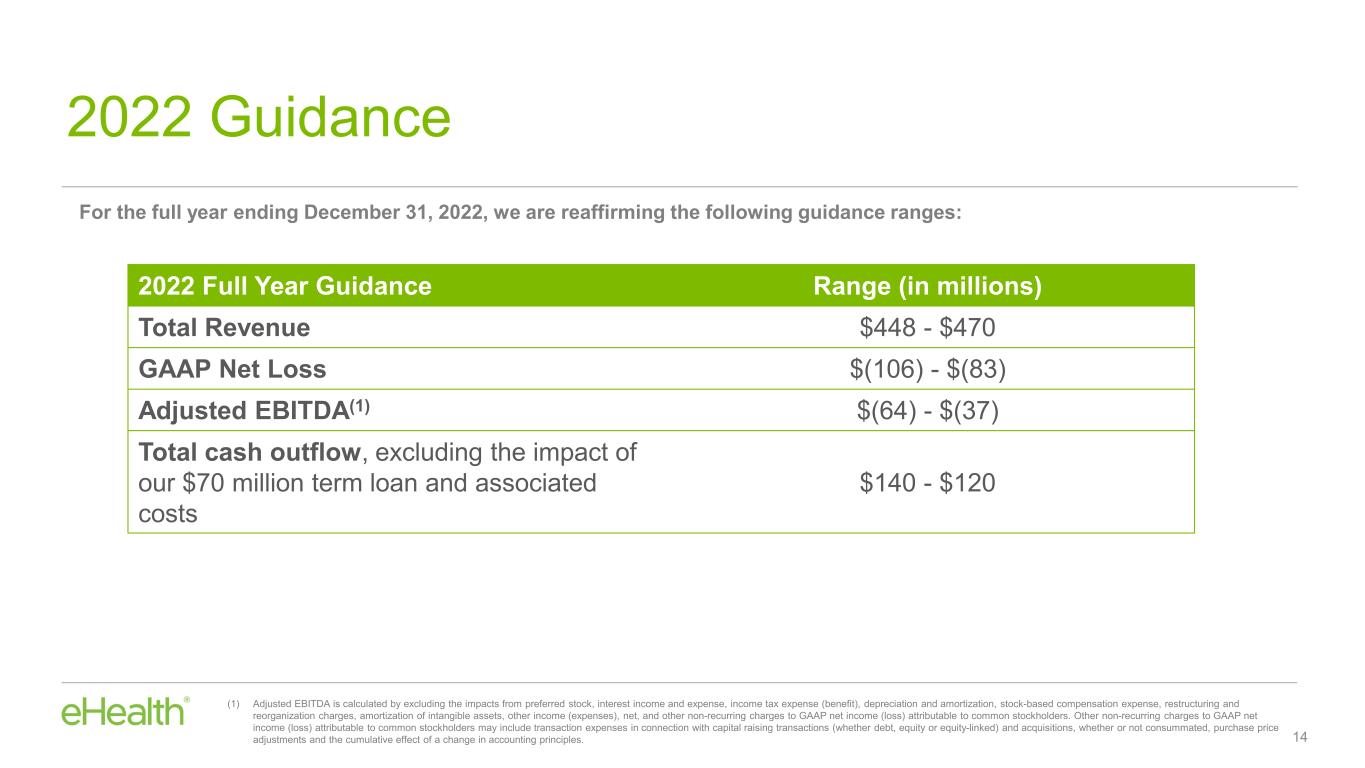

2022 Guidance

Based on information available as of May 3, 2022, we are reaffirming our guidance for the full year ending December 31, 2022. These expectations are forward-looking statements and we assume no obligation to update these statements. Actual results may be materially different and are affected by the risk factors and uncertainties identified in this press release and in eHealth’s annual and quarterly reports filed with the Securities and Exchange Commission.

The following guidance is for the full year ending December 31, 2022:

•Total revenue is expected to be in the range of $448.0 million to $470.0 million.

•GAAP net loss is expected to be in the range of $106.0 million to $83.0 million.

•Adjusted EBITDA(1) is expected to be in the range of $(64.0) million to $(37.0) million.

•Total cash outflow, excluding the impact of our $70.0 million term loan and associated costs, is expected to be in the range of $140.0 million to $120.0 million.

_____________

(1) | See Non-GAAP Financial Information for definitions of our non-GAAP financial measures. | ||||

5

Webcast and Conference Call Information

A webcast and conference call will be held today, Tuesday, May 3, 2022 at 5:00 p.m. Eastern / 2:00 p.m. Pacific Time. The live webcast and supporting presentation slides will be available on the Investor Relations section of eHealth’s website at http://ir.ehealthinsurance.com. Individuals interested in listening to the conference call may do so by dialing (877) 930-8066 for domestic callers and (253) 336-8042 for international callers. The participant passcode is 3371197. A telephone replay will be available two hours following the conclusion of the call for a period of seven days and can be accessed by dialing (855) 859-2056 for domestic callers and (404) 537-3406 for international callers. The call ID for the replay is 3371197. The live and archived webcast of the call will also be available on eHealth's website at http://www.ehealthinsurance.com under the Investor Relations section.

About eHealth, Inc.

eHealth, Inc. (Nasdaq: EHTH) operates a leading online health insurance marketplace at eHealth.com and eHealthMedicare.com with technology that provides consumers with health insurance enrollment solutions. Since 1997, we have connected more than 8 million members with quality, affordable health insurance, Medicare options, and ancillary plans. Our proprietary marketplace offers Medicare Advantage, Medicare Supplement, Medicare Part D prescription drug, individual, family, small business and other plans from approximately 200 health insurance carriers across fifty states and the District of Columbia.

Forward-Looking Statements

This press release contains statements that are forward-looking statements as defined within the Private Securities Litigation Reform Act of 1995. These include statements regarding trends in our business, trends in the Medicare distribution market, our expectations regarding cost savings and returns on investment, the market share of our online business, our estimates regarding total membership, Medicare membership, individual and family plan membership and ancillary and small business membership, our estimates regarding constrained lifetime values of commissions per approved member by product category, our estimates regarding costs per approved member, and our 2022 annual guidance on total revenue, GAAP net loss, adjusted EBITDA, and total cash outflow.

These forward-looking statements are inherently subject to various risks and uncertainties that could cause actual results to differ materially from the statements made. In particular, we are required by Accounting Standards Codification 606 — Revenue from Contracts with Customers to make numerous assumptions that are based on historical trends and our management’s judgment. These assumptions may change over time and have a material impact on our revenue recognition, guidance, and results of operations. Please review the assumptions stated in this press release carefully.

The risks and uncertainties that could cause our results to differ materially from those expressed or implied by such forward-looking statements include our ability to retain existing members and enroll new members during the annual healthcare open enrollment period, the Medicare annual enrollment periods and other special enrollment periods; changes in laws, regulations and guidelines, including in connection with healthcare reform or with respect to the marketing and sale of Medicare plans; competition from government-run health insurance exchanges and other sources; the seasonality of our business and the fluctuation of our operating results; our ability to accurately estimate membership, lifetime value of commissions and commissions receivable; changes in product offerings among carriers on our ecommerce platform and the resulting impact on our commission revenue; our ability to execute on our strategy in the Medicare market; the continued impact of the COVID-19 pandemic on our operations, business, financial condition and growth prospects, as well as on the general economy; changes in our management and key employees; exposure to security risks and our ability to safeguard the security and privacy of confidential data; our relationships with health insurance carriers; the success of our carrier advertising and sponsorship program; customer concentration and consolidation of the health insurance industry; our success in marketing and selling health insurance plans and our unit cost of acquisition; our ability to hire, train, retain and ensure the productivity of licensed health insurance agents and other employees; the need for health insurance carrier and regulatory approvals in connection with the marketing of Medicare-related insurance products; changes in the market for private health insurance; consumer satisfaction of our service and actions we take to improve the quality of enrollments; changes in

6

member conversion rates; changes in commission rates; our ability to sell qualified health insurance plans to subsidy-eligible individuals and to enroll subsidy-eligible individuals through government-run health insurance exchanges; our ability to maintain and enhance our brand identity; our ability to derive desired benefits from investments in our business, including membership growth and retention initiatives; reliance on marketing partners; the impact of our direct-to-consumer email, telephone and television marketing efforts; timing of receipt and accuracy of commission reports; payment practices of health insurance carriers; dependence on our operations in China; the restrictions in our debt obligations; the restrictions in our investment agreement with H.I.G; our ability to raise additional capital; compliance with insurance and other laws and regulations; the outcome of litigation in which we are involved; and the performance, reliability and availability of our information technology systems, ecommerce platform and underlying network infrastructure. Other factors that could cause operating, financial and other results to differ are described in our most recent Quarterly Report on Form 10-Q or Annual Report on Form 10-K filed with the Securities and Exchange Commission and available on the investor relations page of our website at http://www.ehealthinsurance.com and on the Securities and Exchange Commission’s website at www.sec.gov.

All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Non-GAAP Financial Information

This press release includes financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (GAAP). To supplement eHealth’s condensed consolidated financial statements presented in accordance with GAAP, eHealth presents investors with non-GAAP financial measures, including non-GAAP net income (loss); non-GAAP net income (loss) per diluted share; and adjusted EBITDA.

•Non-GAAP net income (loss) consists of GAAP net income (loss) attributable to common stockholders excluding the following items:

▪paid-in-kind dividends for preferred stock and change in preferred stock redemption value (together "impact from preferred stock"),

▪the effects of expensing stock-based compensation related to stock options and restricted stock units,

▪restructuring and reorganization charges,

▪amortization of intangible assets,

▪other non-recurring charges (as noted below), and

▪the income tax impact of non-GAAP adjustments.

•Non-GAAP net income (loss) per diluted share consists of GAAP net income (loss) attributable to common stockholder per diluted share excluding the following items:

▪impact from preferred stock,

▪the effects of expensing stock-based compensation related to stock options and restricted stock units per diluted share,

▪restructuring and reorganization charges per diluted share,

▪amortization of intangible assets per diluted share,

▪other non-recurring charges (as noted below) per diluted share, and

▪the income tax impact of non-GAAP adjustments per diluted share.

7

•Adjusted EBITDA is calculated by excluding the impact from preferred stock, interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, restructuring and reorganization charges, amortization of intangible assets, other income (expense), net, and other non-recurring charges to GAAP net income (loss) attributable to common stockholders. Other non-recurring charges to GAAP net income (loss) attributable to common stockholders may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, purchase price adjustments and the cumulative effect of a change in accounting principles.

8

eHealth believes that the presentation of these non-GAAP financial measures provides important supplemental information to management and investors regarding financial and business trends relating to eHealth’s financial condition and results of operations. Management believes that the use of these non-GAAP financial measures provides consistency and comparability with eHealth’s past financial reports. Management also believes that the items described above provide an additional measure of eHealth’s operating results and facilitates comparisons of eHealth’s core operating performance against prior periods and business model objectives. This information is provided to investors in order to facilitate additional analyses of past, present and future operating performance and as a supplemental means to evaluate eHealth’s ongoing operations. eHealth believes that these non-GAAP financial measures are useful to investors in their assessment of eHealth’s operating performance.

Non-GAAP net income (loss), non-GAAP net income (loss) per diluted share, and adjusted EBITDA are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures used in this press release have limitations in that they do not reflect all of the revenue and costs associated with the operations of eHealth’s business and do not reflect income tax as determined in accordance with GAAP. As a result, you should not consider these measures in isolation or as a substitute for analysis of eHealth’s results as reported under GAAP. eHealth expects to continue to incur the stock-based compensation costs and depreciation and amortization described above, and exclusion of these costs, and their related income tax benefits, from non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent. eHealth compensates for these limitations by prominently disclosing GAAP net income (loss), GAAP net income (loss) attributable to common stockholders and GAAP net income (loss) attributable to common stockholders per diluted share and providing investors with reconciliations from eHealth’s GAAP operating results to the non-GAAP financial measures for the relevant periods.

The accompanying tables provide more details on the GAAP financial measures that are most directly comparable to the non-GAAP financial measures described above and the related reconciliations between these financial measures.

Investor Relations Contact

Kate Sidorovich, CFA

Senior Vice President, Investor Relations & Strategy

2625 Augustine Drive, Second Floor

Santa Clara, CA, 95054

650-210-3111

kate.sidorovich@ehealth.com

http://ir.ehealthinsurance.com

(Tables to Follow)

9

EHEALTH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, Unaudited)

| March 31, 2022 | December 31, 2021 | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 220,563 | $ | 81,926 | |||||||

| Short-term marketable securities | 10,938 | 41,306 | |||||||||

| Accounts receivable | 1,978 | 5,750 | |||||||||

| Contract assets – commissions receivable – current | 204,237 | 254,821 | |||||||||

| Prepaid expenses and other current assets | 11,825 | 23,784 | |||||||||

| Total current assets | 449,541 | 407,587 | |||||||||

| Contract assets – commissions receivable – non-current | 626,941 | 653,441 | |||||||||

| Property and equipment, net | 11,106 | 12,105 | |||||||||

| Operating lease right-of-use assets | 36,099 | 37,373 | |||||||||

| Restricted cash | 3,239 | 3,239 | |||||||||

| Other assets | 35,936 | 35,547 | |||||||||

| Total assets | $ | 1,162,862 | $ | 1,149,292 | |||||||

| Liabilities, convertible preferred stock, and stockholders’ equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 8,196 | $ | 13,750 | |||||||

| Accrued compensation and benefits | 18,501 | 16,458 | |||||||||

| Accrued marketing expenses | 19,537 | 36,384 | |||||||||

| Lease liabilities – current | 5,655 | 5,543 | |||||||||

| Other current liabilities | 8,500 | 3,330 | |||||||||

| Total current liabilities | 60,389 | 75,465 | |||||||||

| Long-term debt | 64,989 | — | |||||||||

| Deferred income taxes – non-current | 42,763 | 50,796 | |||||||||

| Lease liabilities – non-current | 34,410 | 35,826 | |||||||||

| Other non-current liabilities | 4,574 | 5,094 | |||||||||

| Total liabilities | 207,125 | 167,181 | |||||||||

| Convertible preferred stock | 239,810 | 232,592 | |||||||||

| Stockholders’ equity: | |||||||||||

| Common stock | 39 | 39 | |||||||||

| Additional paid-in capital | 762,212 | 755,875 | |||||||||

| Treasury stock, at cost | (199,998) | (199,998) | |||||||||

| Retained earnings | 153,253 | 193,213 | |||||||||

| Accumulated other comprehensive income | 421 | 390 | |||||||||

| Total stockholders’ equity | $ | 715,927 | $ | 749,519 | |||||||

| Total liabilities, convertible preferred stock, and stockholders’ equity | $ | 1,162,862 | $ | 1,149,292 | |||||||

10

EHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts, unaudited)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Revenue: | |||||||||||

| Commission | $ | 93,850 | $ | 127,052 | |||||||

| Other | 11,400 | 7,162 | |||||||||

| Total revenue | 105,250 | 134,214 | |||||||||

Operating costs and expenses(1): | |||||||||||

| Cost of revenue | (127) | 996 | |||||||||

| Marketing and advertising | 58,454 | 50,874 | |||||||||

| Customer care and enrollment | 42,164 | 34,162 | |||||||||

| Technology and content | 19,663 | 23,163 | |||||||||

| General and administrative | 19,987 | 23,054 | |||||||||

| Amortization of intangible assets | — | 176 | |||||||||

| Restructuring and reorganization charges | 4,823 | 2,431 | |||||||||

| Total operating costs and expenses | 144,964 | 134,856 | |||||||||

| Loss from operations | (39,714) | (642) | |||||||||

| Other income (expense), net | (1,021) | 150 | |||||||||

| Loss before income taxes | (40,735) | (492) | |||||||||

| Provision for (benefit from) income taxes | (7,993) | 308 | |||||||||

| Net loss | (32,742) | (800) | |||||||||

| Paid-in-kind dividends for preferred stock | (4,717) | — | |||||||||

| Change in preferred stock redemption value | (2,501) | — | |||||||||

| Net loss attributable to common stockholders: | $ | (39,960) | $ | (800) | |||||||

| Net loss per share attributable to common stockholders: | |||||||||||

| Basic and diluted | $ | (1.46) | $ | (0.03) | |||||||

| Weighted-average number of shares used in per share: | |||||||||||

| Basic and diluted | 27,278 | 26,620 | |||||||||

_____________ (1) Includes stock-based compensation expense as follows: | |||||||||||

| Marketing and advertising | $ | 313 | $ | 2,485 | |||||||

| Customer care and enrollment | 454 | 469 | |||||||||

| Technology and content | 1,850 | 2,743 | |||||||||

| General and administrative | 2,668 | 5,705 | |||||||||

| Total stock-based compensation expense | $ | 5,285 | $ | 11,402 | |||||||

11

EHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, unaudited)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Operating activities: | |||||||||||

| Net loss | $ | (32,742) | $ | (800) | |||||||

| Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 946 | 1,138 | |||||||||

| Amortization of internally developed software | 3,832 | 2,806 | |||||||||

| Amortization of intangible assets | — | 176 | |||||||||

| Stock-based compensation expense | 5,285 | 11,402 | |||||||||

| Deferred income taxes | (8,032) | (570) | |||||||||

| Other non-cash items | 215 | 420 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | 3,773 | (48) | |||||||||

| Contract assets – commissions receivable | 77,142 | 50,635 | |||||||||

| Prepaid expenses and other assets | 12,418 | 4,225 | |||||||||

| Accounts payable | (5,525) | (25,826) | |||||||||

| Accrued compensation and benefits | 2,042 | 4,088 | |||||||||

| Accrued marketing expenses | (16,848) | (6,712) | |||||||||

| Deferred revenue | (223) | 570 | |||||||||

| Accrued expenses and other liabilities | 4,829 | 1,305 | |||||||||

| Net cash provided by operating activities | 47,112 | 42,809 | |||||||||

| Investing activities: | |||||||||||

| Capitalized internal-use software and website development costs | (4,205) | (3,242) | |||||||||

| Purchases of property and equipment and other assets | (55) | (1,899) | |||||||||

| Purchases of marketable securities | (3,938) | (7,771) | |||||||||

| Proceeds from redemption and maturities of marketable securities | 34,319 | 23,409 | |||||||||

| Net cash provided by investing activities | 26,121 | 10,497 | |||||||||

| Financing activities: | |||||||||||

| Net proceeds from debt financing | 64,862 | — | |||||||||

| Net proceeds from exercise of common stock options and employee stock purchases | 1,054 | 285 | |||||||||

| Repurchase of shares to satisfy employee tax withholding obligations | (508) | (5,037) | |||||||||

| Principal payments in connection with leases | (35) | (38) | |||||||||

| Net cash provided by (used in) financing activities | 65,373 | (4,790) | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 31 | (25) | |||||||||

Net increase in cash, cash equivalents and restricted cash | 138,637 | 48,491 | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 85,165 | 47,113 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 223,802 | $ | 95,604 | |||||||

12

EHEALTH, INC.

SEGMENT INFORMATION

(In thousands, unaudited)

| Three Months Ended March 31, | % Change | ||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| Revenue | |||||||||||||||||

Medicare (1) | $ | 95,067 | $ | 121,021 | (21) | % | |||||||||||

Individual, Family and Small Business (2) | 10,183 | 13,193 | (23) | % | |||||||||||||

| Total revenue | $ | 105,250 | $ | 134,214 | (22) | % | |||||||||||

| Segment profit (loss) | |||||||||||||||||

Medicare segment profit (loss) (3) | $ | (14,817) | $ | 24,545 | (160) | % | |||||||||||

Individual, Family and Small Business segment profit (3) | 5,254 | 8,052 | (35) | % | |||||||||||||

| Total segment profit (loss) | (9,563) | 32,597 | (129) | % | |||||||||||||

Corporate (4) | (15,265) | (15,286) | * | ||||||||||||||

| Stock-based compensation expense | (5,285) | (11,402) | (54) | % | |||||||||||||

| Depreciation and amortization | (4,778) | (3,944) | 21 | % | |||||||||||||

| Amortization of intangible assets | — | (176) | (100) | % | |||||||||||||

| Restructuring and reorganization charges | (4,823) | (2,431) | 98 | % | |||||||||||||

| Other income (expense), net | (1,021) | 150 | (781) | % | |||||||||||||

| Loss before income taxes | $ | (40,735) | $ | (492) | 8,179 | % | |||||||||||

__________

* Percentage not meaningful.

Segment Information

We evaluate our business performance and manage our operations as two distinct reporting segments:

•Medicare; and

•Individual, Family and Small Business.

| (1) | The Medicare segment consists primarily of amounts earned from our sale of Medicare-related health insurance plans, including Medicare Advantage, Medicare Supplement and Medicare Part D prescription drug plans, fees for the performance of administrative services and to a lesser extent, amounts from our sale of ancillary products sold to our Medicare-eligible customers, including but not limited to, dental and vision plans, as well as amounts we are paid in connection with our advertising program for marketing and other services. | ||||

| (2) | The Individual, Family and Small Business segment consists primarily of amounts earned from our sale of individual, family and small business health insurance plans and ancillary products sold to our non-Medicare-eligible customers, including but not limited to, dental, vision, and short-term insurance. To a lesser extent, the Individual, Family and Small Business segment consists of amounts earned from our online sponsorship program that allows carriers to purchase advertising space in specific markets in a sponsorship area on our website, our licensing to third parties the use of our health insurance ecommerce technology, and our delivery and sale to third parties of individual and family health insurance plans leads generated by our ecommerce platforms and our marketing activities. | ||||

| (3) | Segment profit (loss) is calculated as revenue for the applicable segment less marketing and advertising, customer care and enrollment, technology and content and general and administrative operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring and reorganization charges and amortization of intangible assets, that are directly attributable to the applicable segment and other indirect marketing and advertising, customer care and enrollment and technology and content operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring and reorganization charges, and amortization of intangible assets, allocated to the applicable segment based on usage. | ||||

| (4) | Corporate consists of other indirect general and administrative operating expenses, excluding stock-based compensation expense, depreciation and amortization, which are managed in a corporate shared services environment and, because they are not the responsibility of segment operating management, are not allocated to the reportable segments. | ||||

13

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

COMMISSION REVENUE BY PRODUCT

(In thousands, unaudited)

| Three Months Ended March 31, | % Change | ||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| Medicare | |||||||||||||||||

| Medicare Advantage | $ | 78,130 | $ | 103,525 | (25) | % | |||||||||||

| Medicare Supplement | 6,120 | 8,222 | (26) | % | |||||||||||||

| Medicare Part D | 1,460 | 1,736 | (16) | % | |||||||||||||

| Total Medicare | 85,710 | 113,483 | (24) | % | |||||||||||||

Individual and Family (1) | |||||||||||||||||

| Non-Qualified Health Plans | 1,610 | 3,367 | (52) | % | |||||||||||||

| Qualified Health Plans | 1,516 | 2,100 | (28) | % | |||||||||||||

| Total Individual and Family | 3,126 | 5,467 | (43) | % | |||||||||||||

| Ancillary | |||||||||||||||||

| Short-term | 1,343 | 1,756 | (24) | % | |||||||||||||

| Dental | 831 | 1,728 | (52) | % | |||||||||||||

| Vision | 243 | 205 | 19 | % | |||||||||||||

| Other | 414 | 35 | 1,083 | % | |||||||||||||

| Total Ancillary | 2,831 | 3,724 | (24) | % | |||||||||||||

| Small Business | 3,483 | 3,223 | 8 | % | |||||||||||||

| Commission Bonus and Other | (1,300) | 1,155 | (213) | % | |||||||||||||

| Total Commission Revenue | $ | 93,850 | $ | 127,052 | (26) | % | |||||||||||

_______

(1) | We define our Individual and Family plan offerings as major medical individual and family health insurance plans, which does not include Medicare-related, small business or ancillary plans. Individual and family health insurance plans include both qualified and non-qualified plans. Qualified health plans are individual and family health insurance plans that meet the requirements of the Affordable Care Act and are offered through the government-run health insurance exchange in the relevant jurisdiction. Non-qualified health plans are Individual and Family plans that meet the requirements of the Affordable Care Act and are not offered through the exchange in the relevant jurisdiction. Individuals that purchase non-qualified health plans cannot receive a subsidy in connection with the purchase of those plans. | ||||

14

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

COMMISSION REVENUE SUMMARY

(In thousands, unaudited)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Medicare: | |||||||||||

| Commission Revenue from Members Approved During the Period | $ | 84,283 | $ | 114,678 | |||||||

Net Commission Revenue from Members Approved in Prior Periods (1) | 51 | 14 | |||||||||

| Total Medicare Segment Commission Revenue | 84,334 | 114,692 | |||||||||

| Individual, Family and Small Business: | |||||||||||

| Commission Revenue from Members Approved During the Period | 6,042 | 6,395 | |||||||||

Commission Revenue from Renewals of Small Business Members During the Period (2) | 3,037 | 2,687 | |||||||||

Net Commission Revenue from Members Approved in Prior Periods (1)(2) | 437 | 3,278 | |||||||||

| Total Individual, Family and Small Business Segment Commission Revenue | 9,516 | 12,360 | |||||||||

| Total Commission Revenue | $ | 93,850 | $ | 127,052 | |||||||

________

(1) | These amounts reflect our revised estimates of cash collections for certain members approved prior to the relevant reporting period that are recognized as net adjustment revenue within the relevant reporting period. The net adjustment revenue includes both increases in revenue for certain prior period cohorts as well as reductions in revenue for certain prior period cohorts. | ||||

(2) | Commission revenue from renewals of small business members during the period was previously included in net commission revenue from members approved in prior periods. However, starting in the first quarter of 2021, we enhanced our reporting by separately disclosing commission revenue from renewals of small business members during the period in a separate line item. | ||||

15

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

APPROVED AND NEW PAYING MEMBERSHIP

(Unaudited)

| Three Months Ended March 31, | % Change | ||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| Approved Members | |||||||||||||||||

| Medicare Advantage | 82,431 | 106,884 | (23)% | ||||||||||||||

| Medicare Supplement | 6,556 | 7,782 | (16)% | ||||||||||||||

| Medicare Part D | 6,823 | 8,011 | (15)% | ||||||||||||||

| Total Medicare | 95,810 | 122,677 | (22) | % | |||||||||||||

| Individual and Family | 9,801 | 11,314 | (13) | % | |||||||||||||

| Ancillary | 18,970 | 26,511 | (28) | % | |||||||||||||

| Small Business | 2,514 | 2,948 | (15) | % | |||||||||||||

| Total Approved Members | 127,095 | 163,450 | (22) | % | |||||||||||||

| New Paying Members | |||||||||||||||||

| Medicare Advantage | 117,643 | 140,997 | (17) | % | |||||||||||||

| Medicare Supplement | 7,062 | 9,996 | (29) | % | |||||||||||||

| Medicare Part D | 27,384 | 29,139 | (6) | % | |||||||||||||

| Total Medicare | 152,089 | 180,132 | (16) | % | |||||||||||||

| Individual and Family | 16,230 | 17,607 | (8) | % | |||||||||||||

| Ancillary | 22,917 | 31,591 | (27) | % | |||||||||||||

| Small Business | 3,084 | 4,125 | (25) | % | |||||||||||||

| Total New Paying Members | 194,320 | 233,455 | (17) | % | |||||||||||||

Approved Members

Approved members represent the number of individuals on submitted applications that were approved by the relevant insurance carrier for the identified product during the current period. The applications may be submitted in either the current period or prior periods. Not all approved members ultimately become paying members.

New Paying Members

New paying members consist of approved members from the period presented and any periods prior to the period presented from whom we have received an initial commission payment during the period presented.

16

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

ESTIMATED MEMBERSHIP

(Unaudited)

| As of March 31, | % Change | ||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

Medicare (1) | |||||||||||||||||

| Medicare Advantage | 585,824 | 538,716 | 9 | % | |||||||||||||

| Medicare Supplement | 100,006 | 104,727 | (5) | % | |||||||||||||

| Medicare Part D | 219,801 | 229,598 | (4) | % | |||||||||||||

| Total Medicare | 905,631 | 873,041 | 4 | % | |||||||||||||

Individual and Family(2) | 104,849 | 103,844 | 1 | % | |||||||||||||

Ancillary (3) | 229,284 | 241,415 | (5) | % | |||||||||||||

Small Business (4) | 47,876 | 45,207 | 6 | % | |||||||||||||

| Total Estimated Membership | 1,287,640 | 1,263,507 | 2 | % | |||||||||||||

_____________

(1) | To estimate the number of members on Medicare-related health insurance plans, we take the sum of (i) the number of members for whom we have received or applied a commission payment for a month that may be up to three months prior to the date of estimation (after reducing that number using historical experience for assumed member cancellations over the period being estimated); and (ii) the number of approved members over that period (after reducing that number using historical experience for an assumed number of members who do not accept their approved policy and for estimated member cancellations through the date of the estimate). To the extent we determine through confirmations from a health insurance carrier that a commission payment is delayed or is inaccurate as of the date of estimation, we adjust the estimated membership to also reflect the number of members for whom we expect to receive or to refund a commission payment. Further, to the extent we have received substantially all of the commission payments related to a given month during the period being estimated, we will take the number of members for whom we have received or applied a commission payment during the month of estimation. | ||||

(2) | To estimate the number of members on Individual and Family plans, we take the sum of (i) the number of Individual and Family plan members for whom we have received or applied a commission payment for a month that may be up to three months prior to the date of estimation (after reducing that number using historical experience for assumed member cancellations over the period being estimated); and (ii) the number of approved members over that period (after reducing that number using historical experience for an assumed number of members who do not accept their approved policy and for estimated member cancellations through the date of the estimate). To the extent we determine we have received substantially all of the commission payments related to a given month during the period being estimated, we will take the number of members for whom we have received or applied a commission payment during the month of estimation. | ||||

(3) | To estimate the number of members on ancillary health insurance plans (such as short-term, dental and vision insurance), we take the sum of (i) the number of members for whom we have received or applied a commission payment for a month that may be up to three months prior to the date of estimation (after reducing that number using historical experience for assumed member cancellations over the period being estimated); and (ii) the number of approved members over that period (after reducing that number using historical experience for an assumed number of members who do not accept their approved policy and for estimated member cancellations through the date of the estimate). To the extent we determine we have received substantially all of the commission payments related to a given month during the period being estimated, we will take the number of members for whom we have received or applied a commission payment during the month of estimation. The one to three-month period varies by insurance product and is largely dependent upon the timeliness of commission payment and related reporting from the related carriers. | ||||

(4) | To estimate the number of members on small business health insurance plans, we use the number of initial members at the time the group was approved, and we update this number for changes in membership if such changes are reported to us by the group or carrier. However, groups generally notify the carrier directly of policy cancellations and increases or decreases in group size without informing us. Health insurance carriers often do not communicate policy cancellation information or group size changes to us. We often are made aware of policy cancellations and group size changes at the time of annual renewal and update our membership statistics accordingly in the period they are reported. | ||||

17

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

ESTIMATED MEMBERSHIP (Continued)

(Unaudited)

Estimated Membership

Estimated membership represents the estimated number of members active as of the date indicated based on the estimation methodology above.

Health insurance carriers bill and collect insurance premiums paid by our members. The carriers do not report to us the number of members that we have as of a given date. The majority of our members who terminate their policies do so by discontinuing their premium payments to the carrier and do not inform us of the cancellation. Also, some of our members pay their premiums less frequently than monthly. Given the number of months required to observe non-payment of commissions in order to confirm cancellations, we estimate the number of members who are active on insurance policies as of a specified date.

After we have estimated membership for a period, we may receive information from health insurance carriers that would have impacted the estimate if we had received the information prior to the date of estimation. We may receive commission payments or other information that indicates that a member who was not included in our estimates for a prior period was in fact an active member at that time, or that a member who was included in our estimates was in fact not an active member of ours. For instance, we reconcile information carriers provide to us and may determine that we were not historically paid commissions owed to us, which would cause us to have underestimated membership. Conversely, carriers may require us to return commission payments paid in a prior period due to policy cancellations for members we previously estimated as being active. We do not update our estimated membership numbers reported in previous periods. Instead, we reflect updated information regarding our historical membership in the membership estimate for the current period. If we experience a significant variance in historical membership as compared to our initial estimates, we keep the prior period data consistent with previously reported amounts, while we may provide the updated information in other communications. As a result of the delay in our receipt of information from insurance carriers, actual trends in our membership are most discernible over periods longer than from one quarter to the next. As a result of the delay we experience in receiving information about our membership, it is difficult for us to determine with any certainty the impact of current conditions on our membership retention. Various circumstances could cause the assumptions and estimates that we make in connection with estimating our membership to be inaccurate, which would cause our membership estimates to be inaccurate.

18

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

CONSTRAINED LIFETIME VALUE OF

COMMISSIONS PER APPROVED MEMBER

(Unaudited)

| Three Months Ended March 31, | % Change | ||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| Medicare | |||||||||||||||||

Medicare Advantage (1) | $ | 948 | $ | 968 | (2) | % | |||||||||||

Medicare Supplement (1) | 927 | 1,057 | (12) | % | |||||||||||||

Medicare Part D (1) | 213 | 217 | (2) | % | |||||||||||||

| Individual and Family | |||||||||||||||||

Non-Qualified Health Plans (1) | 330 | 200 | 65 | % | |||||||||||||

Qualified Health Plans (1) | 302 | 298 | 1 | % | |||||||||||||

| Ancillary | |||||||||||||||||

Short-term (1) | 182 | 180 | 1 | % | |||||||||||||

Dental (1) | 104 | 91 | 14 | % | |||||||||||||

Vision (1) | 62 | 59 | 5 | % | |||||||||||||

Small Business (2) | 198 | 182 | 9 | % | |||||||||||||

Constrained Lifetime Value of Commissions Per Approved Member

| (1) | Constrained lifetime value (“LTV”) of commissions per approved member represents commissions estimated to be collected over the estimated life of an approved member’s plan after applying constraints in accordance with our revenue recognition policy. The estimate is driven by multiple factors, including but not limited to, contracted commission rates, carrier mix, estimated average plan duration, the regulatory environment, and cancellations of insurance plans offered by health insurance carriers with which we have a relationship. These factors may result in varying values from period to period. | ||||

| (2) | For small business, the amount represents the estimated commissions we expect to collect from the plan over the following twelve months. The estimate is driven by multiple factors, including but not limited to, contracted commission rates, carrier mix, estimated average plan duration, the regulatory environment, and cancellations of insurance plans offered by health insurance carriers with which we have a relationship and applied constraints. These factors may result in varying values from period to period. | ||||

19

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

CONSTRAINTS ON LIFETIME VALUE OF

COMMISSIONS PER APPROVED MEMBER

(Unaudited)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Medicare | |||||||||||

| Medicare Advantage | 7 | % | 7 | % | |||||||

| Medicare Supplement | 9 | % | 5 | % | |||||||

| Medicare Part D | 7 | % | 5 | % | |||||||

| Individual and Family | |||||||||||

| Non-Qualified Health Plans | 7 | % | 15 | % | |||||||

| Qualified Health Plans | 4 | % | 4 | % | |||||||

| Certain Ancillary Products | |||||||||||

| Short-term | 20 | % | 20 | % | |||||||

| Dental | 5 | % | 7 | % | |||||||

| Vision | 5 | % | 5 | % | |||||||

| Other | 10 | % | 10 | % | |||||||

| Small Business | 5 | % | 5 | % | |||||||

Constraints on Lifetime Value of Commissions Per Approved Member

Constraints are applied to derive LTV of commissions per approved member for revenue recognition in accordance with our revenue recognition policy. The constraints are applied to help ensure that commissions estimated to be collected over the estimated life of an approved member’s plan are recognized as revenue only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with future commissions receivable from the plan is subsequently resolved. We evaluate constraints on a quarterly basis for factors affecting our estimate of LTV of commissions per approved member and apply management judgment to determine the constraints based on current trends impacting our business.

20

EHEALTH, INC.

SUMMARY OF SELECTED METRICS

EXPENSE METRICS PER APPROVED MEMBER

(Unaudited)

| Three Months Ended March 31, | % Change | ||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| Medicare: | |||||||||||||||||

Estimated customer care and enrollment ("CC&E") cost per approved Medicare Advantage ("MA")-equivalent approved member (1) | $ | 441 | $ | 278 | 59 | % | |||||||||||

Estimated variable marketing cost per MA-equivalent approved member (1) | 545 | 353 | 54 | % | |||||||||||||

| Total Medicare estimated cost per approved member | $ | 986 | $ | 631 | 56 | % | |||||||||||

| Individual and Family Plan ("IFP"): | |||||||||||||||||

Estimated CC&E cost per IFP-equivalent approved member (2) | $ | 88 | $ | 63 | 40 | % | |||||||||||

Estimated variable marketing cost per IFP-equivalent approved member (2) | 49 | 44 | 11 | % | |||||||||||||

| Total IFP estimated cost per approved member | $ | 137 | $ | 107 | 28 | % | |||||||||||

_____________

(1) | MA-equivalent approved members is a derived metric with a Medicare Part D approved member being weighted at 25% of a Medicare Advantage member and a Medicare Supplement member based on their relative LTVs at the time of our adoption of Accounting Standards Codification 606 – Revenue from Contracts with Customers (“ASC 606”). We calculate the number of approved MA-equivalent members by adding the total number of approved Medicare Advantage and Medicare Supplement members and 25% of the total number of approved Medicare Part D members during the period presented. | ||||

(2) | IFP-equivalent approved members is a derived metric with a short-term approved member being weighted at 33% of a major medical individual and family health insurance plan member based on their relative LTVs at the time of our adoption of ASC 606. We calculate the number of approved IFP-equivalent members by adding the total number of approved qualified and non-qualified health plan members and 33% of the total number of short-term approved members during the period presented. | ||||

Expense Metrics Per Approved Member

Marketing initiatives are an important component of our strategy to increase revenue and are primarily designed to encourage consumers to complete an application for health insurance. Variable marketing cost represents direct costs incurred in member acquisition from our direct, marketing partners and online advertising channels. In addition, we incur customer care and enrollment expenses in assisting applicants, including during the enrollment process.

The numerator used to calculate each metric is the portion of the respective operating expenses for marketing and advertising and customer care and enrollment that is directly related to member acquisition for our sale of Medicare Advantage, Medicare Supplement and Medicare Part D prescription drug plans (collectively, the “Medicare Plans”) and for all IFP plans including individual and family plans and short-term health insurance (collectively, the “IFP Plans”), respectively. The denominator used to calculate each metric is based on a derived metric that represents the relative value of the new members acquired. For Medicare Plans, we call this derived metric Medicare Advantage (“MA”)-equivalent members, and for IFP Plans, we call this derived metric IFP-equivalent members. The calculations for MA-equivalent members and for IFP-equivalent members are based on the weighted number of approved members for Medicare Plans and IFP Plans during the period, with the number of approved members adjusted based on the relative LTV of the product they are purchasing. Since the LTV for any product fluctuates from period to period, the weight given to each product was determined based on their relative LTVs at the time of our adoption of ASC 606. Variable marketing costs exclude fixed overhead costs, such as personnel related costs, consulting expenses, facilities and other operating costs allocated to the marketing and advertising department.

21

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, unaudited)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| GAAP marketing and advertising expense | $ | 58,454 | $ | 50,874 | |||||||

Stock-based compensation expense (1) | (313) | (2,485) | |||||||||

| Non-GAAP marketing and advertising expense | $ | 58,141 | $ | 48,389 | |||||||

| GAAP customer care and enrollment expense | $ | 42,164 | $ | 34,162 | |||||||

Stock-based compensation expense (1) | (454) | (469) | |||||||||

| Non-GAAP customer care and enrollment expense | $ | 41,710 | $ | 33,693 | |||||||

| GAAP technology and content expense | $ | 19,663 | $ | 23,163 | |||||||

Stock-based compensation expense (1) | (1,850) | (2,743) | |||||||||

| Non-GAAP technology and content expense | $ | 17,813 | $ | 20,420 | |||||||

| GAAP general and administrative expense | $ | 19,987 | $ | 23,054 | |||||||

Stock-based compensation expense (1) | (2,668) | (5,705) | |||||||||

| Non-GAAP general and administrative expense | $ | 17,319 | $ | 17,349 | |||||||

_______

(1)Non-GAAP expenses exclude the effect of expensing stock-based compensation related to stock options, restricted stock awards, performance-based and market-based equity awards, and employee stock purchase plan.

22

EHEALTH, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES(1)

(In thousands, except per share amounts, unaudited)

| Three Months Ended March 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Net loss attributable to common stockholders: | $ | (39,960) | $ | (800) | |||||||

| Paid-in-kind dividends for preferred stock | 4,717 | — | |||||||||

| Change in preferred stock redemption value | 2,501 | — | |||||||||

| GAAP net loss | (32,742) | (800) | |||||||||

| Stock-based compensation expense | 5,285 | 11,402 | |||||||||

| Amortization of intangible assets | — | 176 | |||||||||

| Restructuring and reorganization charges | 4,823 | 2,431 | |||||||||

| Tax effect of non-GAAP adjustments | (2,289) | (3,826) | |||||||||

| Non-GAAP net income (loss) | $ | (24,923) | $ | 9,383 | |||||||

| GAAP net loss attributable to common stockholders per diluted share | $ | (1.46) | $ | (0.03) | |||||||

| Impact from preferred stock | 0.26 | — | |||||||||

| Stock-based compensation expense | 0.19 | 0.43 | |||||||||

| Amortization of intangible assets | — | 0.01 | |||||||||

| Restructuring and reorganization charges | 0.18 | 0.09 | |||||||||

| Tax effect of non-GAAP adjustments | (0.08) | (0.14) | |||||||||

| Non-GAAP net income (loss) per diluted share | $ | (0.91) | $ | 0.36 | |||||||

| Net loss attributable to common stockholders: | $ | (39,960) | $ | (800) | |||||||

| Paid-in-kind dividends for preferred stock | 4,717 | — | |||||||||

| Change in preferred stock redemption value | 2,501 | — | |||||||||

| GAAP net loss | (32,742) | (800) | |||||||||

| Stock-based compensation expense | 5,285 | 11,402 | |||||||||

| Depreciation and amortization | 4,778 | 3,944 | |||||||||

| Amortization of intangible assets | — | 176 | |||||||||

| Restructuring and reorganization charges | 4,823 | 2,431 | |||||||||

| Other (income) expense, net | 1,021 | (150) | |||||||||

| Provision for (benefit from) income taxes | (7,993) | 308 | |||||||||

| Adjusted EBITDA | $ | (24,828) | $ | 17,311 | |||||||

_______

(1) See Non-GAAP Financial Information section for definitions of our non-GAAP financial measures.

23

EHEALTH, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO GUIDANCE (1)

(In millions, unaudited)

| Full Year 2022 Guidance | |||||||||||

| Low | High | ||||||||||

| GAAP net loss attributable to common stockholders | $ | (137.0) | $ | (114.0) | |||||||

| Impact from preferred stock | 31.0 | 31.0 | |||||||||

| GAAP net loss | (106.0) | (83.0) | |||||||||

| Stock-based compensation expense | 31.0 | 31.0 | |||||||||

| Depreciation and amortization | 18.0 | 18.0 | |||||||||

| Restructuring and reorganization charges | 15.0 | 15.0 | |||||||||

| Amortization of intangible assets | — | — | |||||||||

| Other income, net | (1.0) | (1.0) | |||||||||

| Benefit from income taxes | (21.0) | (17.0) | |||||||||

| Adjusted EBITDA | $ | (64.00) | $ | (37.00) | |||||||

_____________

(1) | See Non-GAAP Financial Information for definitions of our non-GAAP financial measures. | ||||

24

May 3, 2022 Q1 2022 Financial Results Conference Call Slides

The image part with relationship ID rId17 was not found in the file. Safe Harbor Statement 1 Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the federal securities laws. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements in this presentation include, but are not limited to, the following: our annual enrollment opportunity; our operational focus in 2022; our expected cash collections for Medicare Advantage plans; our estimated memberships; our long-term opportunities for profitable growth; and our 2022 annual guidance for total revenue, GAAP net loss, adjusted EBITDA, and total cash flow. Our expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks include those set forth in our filings with the Securities and Exchange Commission, including our latest Form 10-Q and 10-K. The forward-looking statements in this presentation are based on information available to us as of today, and we disclaim any obligation to update any forward-looking statements, except as required by law. Non-GAAP Information This presentation includes both GAAP and non-GAAP financial measures. The presentation of non-GAAP financial information is not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP. A reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP financial measures is available in the Appendix to this presentation. Management uses both GAAP and non-GAAP information in evaluating and operating its business internally and as such has determined that it is important to provide this information to investors.

The image part with relationship ID rId17 was not found in the file. 8.0m Our Enrollment Remains a Small Portion of our Total Medicare Advantage Annual Opportunity 2 4.2m 3.8m Estimated New to MA (Age-ins + shifted from traditional Medicare) Estimated Switchers Within MA Estimated Medicare Advantage Opportunity for FY 2021 (1) (2) 400k eHealth’s 400k Medicare Advantage Approved Members in FY2021 represented 5% of total estimated annual enrollment opportunity Tapping into a large greenfield opportunity. New to MA members represented ~43% of our total MA approved members with policy effective date of Jan 1, 2022 (1) We estimate our New to MA opportunity as follows: 2021 total enrollment growth for MA enrollments, net of estimated deaths and individuals that left MA (assumed at 5% of 2020 total MA enrollments) (Source: CMS) (2) We estimate 2021 Switchers within MA as follows: total 2020 MA enrollments (Source: CMS) multiplied by an assumed 15% annual switching rate, based on 11% switching during the AEP and 4% during OEP (Source: Deft). (3) Sum of estimated Switchers within MA and Estimated New to MA members. eHealth’s Approved MA members for FY 2021 (3)

The image part with relationship ID rId17 was not found in the file. Q1 2022 Financial Highlights 3 Estimated commission generating Medicare Advantage membership of 586K grew 9% year-over-year Q1 2022 revenue declined 22% year-over-year to $105.3MM; Q1 2022 GAAP net loss was $(32.7)MM (1) Adjusted EBITDA is calculated by excluding the paid-in-kind dividends and change in preferred stock redemption value (together “impacts from preferred stock”), interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, restructuring and reorganization charges, amortization of intangible assets, other income (expenses), net, and other non-recurring charges to GAAP net income (loss) attributable to common stockholders. Other non-recurring charges to GAAP net income (loss) attributable to common stockholders may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, purchase price adjustments and the cumulative effect of a change in accounting principles. Total Medicare approved members declined by 22% year-over-year Medicare Advantage LTV of $948 decreased 2% year-over-year from $968 in Q1 2021 Adjusted EBITDA(1) loss of ($24.8)MM, compared to $17.3MM in Q1 2021 Fully unassisted online submissions for Medicare Advantage grew 50% compared to Q1 2021 Q1 enrollments and revenue declined YoY reflecting lower telephonic conversions and our decision to reduce investment in agent-driven enrollments in 2022 Online business continued to scale driving significant enrollment growth at attractive unit economics

The image part with relationship ID rId17 was not found in the file. - 100,000 200,000 300,000 400,000 500,000 600,000 700,000 - 50,000 100,000 150,000 200,000 250,000 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Es tim at ed M em be rs hi p Ap pr ov ed \N ew P ay in g M em be rs Approved MA Members (1) New Paying MA Members (2) Estimated Ending (Paying) MA Membership (3) eHealth MA Membership Growth 4 Paying policies with policy effective date Jan 1, 2022 (last AEP enrollments) demonstrated persistency through the first three active months more than 10% higher than cohorts with effective dates of Jan 1, 2021. (1) Approved MA members consist of the number of individuals on submitted applications that were approved by the relevant insurance carrier for the identified product during the period presented. Approved members may not pay for their plan and become paying members. (2) New Paying MA Members consist of approved members from the period presented and any periods prior to the period presented from whom we have received an initial commission payment during the period presented. (3) Estimated Ending (Paying) MA Membership is the number of members we estimate as of the end of the period. Membership is estimated using the methodology described in our periodic filings with the Securities and Exchange Commission.

The image part with relationship ID rId17 was not found in the file. Q1 2022 Total Revenue 5 Total revenue declined 22% on a year-over-year basis due primarily to a $27.8 million decrease in Medicare commission revenue. In the remainder of 2022, we plan to back on our investment in telephonic enrollments to reduce reliance on our lowest ROI demand generation channels as we implement initiatives to increase the effectiveness of our marketing and telesales organization Decline in approved Medicare commission revenue during the quarter was partially offset by a year- over-year increase in Medicare advertising revenue of $4.9 million. Total Revenue $ 134.2 $ 105.3 Q1-FY21 Q1-FY22 Total Revenue ($MM) (22%)

The image part with relationship ID rId17 was not found in the file. 7,853 11,567 Q1-FY21 Q1-FY22 Major Medicare Online Unassisted Submissions 47% Q1 2022 Major Medicare Online Applications 6 (1) Major Medicare plans include Medicare Advantage and Medicare Supplement plans Major Medicare Online Unassisted SubmissionsOnline business continues to generate strong growth. Unassisted online applications for major Medicare(1) products grew 47% year-over- year 11.5% of major Medicare submissions were online unassisted for Q1 2022 compared to 6% in Q1 2021

The image part with relationship ID rId17 was not found in the file. Q1 2022 Net Loss and Adj. EBITDA(1) 7 (1) Adjusted EBITDA is calculated by excluding the impacts from preferred stock, interest income and expense, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, restructuring and reorganization charges, amortization of intangible assets, other income (expenses), net, and other non-recurring charges to GAAP net income (loss) attributable to common stockholders. Other non-recurring charges to GAAP net income (loss) attributable to common stockholders may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, purchase price adjustments and the cumulative effect of a change in accounting principles. Exceeded expectations due to significant growth in Medicare enrollments Net Loss Adjusted EBITDA Q1 2022 Net Loss and Adjusted EBITDA reflect the impact of lower telephonic conversion rates and the early stages of the implementation of our cost transformation initiatives. ($0.8) ($32.7) Q1-FY21 Q1-FY22 Net Loss ($MM) $17.3 ($24.8) Q1-FY21 Q1-FY22 Adjusted EBITDA ($MM)

The image part with relationship ID rId17 was not found in the file. Q1 2022 Medicare Segment Revenue and Loss 8 Medicare Segment Revenue Medicare Segment Profit (Loss) (1) (1) Segment profit (loss) is calculated as revenue for the applicable segment less marketing and advertising, customer care and enrollment, technology and content and general and administrative operating expenses, excluding stock- based compensation expense, depreciation and amortization, restructuring and reorganization charges, and amortization of intangible assets, that are directly attributable to the applicable segment and other indirect marketing and advertising, customer care and enrollment and technology and content operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring and reorganization charges, and amortization of intangible assets, allocated to the applicable segment based on usage. $121.0 $95.1 Q1-FY21 Q1-FY22 Medicare Segment Revenue ($MM) (21%) $24.5 ($14.8) Q1-FY21 Q1-FY22 Medicare Segment Profit (Loss) ($MM) Q1 2022 Medicare segment revenue and earnings declined on a year-over-year basis. Medicare commission revenue declined 24% while advertising revenue grew 88% YoY Medicare residual or “tail” revenue was positive, just over zero

The image part with relationship ID rId17 was not found in the file. IFP/SMB Revenue and Segment Profit declined compared to Q1 2022 due to lower IFP/SMB tail revenue of $3.0MM compared to $5.3MM million in Q1 of 2021 IFP initial revenue grew 10% year-over-year in Q1 2022 Q1 2022 IFP/SMB Segment Revenue and Profit 9 IFP/SMB Segment Revenue IFP/SMB Segment Profit (1) (1) Segment profit is calculated as revenue for the applicable segment less marketing and advertising, customer care and enrollment, technology and content and general and administrative operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring and reorganization charges, and amortization of intangible assets, that are directly attributable to the applicable segment and other indirect marketing and advertising, customer care and enrollment and technology and content operating expenses, excluding stock-based compensation expense, depreciation and amortization, restructuring and reorganization charges, and amortization of intangible assets, allocated to the applicable segment based on usage. $13.2 $10.2 Q1-FY21 Q1-FY22 Individual, Family, and Small Business Segment Revenue ($MM) (23%) $8.1 $5.3 Q1-FY21 Q1-FY22 Individual, Family, and Small Business Segment Profit ($MM) (35%)

The image part with relationship ID rId17 was not found in the file. 2020 MA cohorts have now achieved break even, i.e., the variable acquisition cost compared to cash collections generated by the cohort to date These cohorts will be generating positive cash flow going forward as we continue to collect monthly renewal payments. Medicare Advantage Variable Cost and Cash Collection 10 (1) Medicare Advantage (MA) variable cost and cash collections are grouped by member cohorts based on policy effective date (2) Variable cost includes variable marketing and customer care & enrollment costs allocated to the MA members (3) Cash collected are commissions for MA members. For the first year, it also includes non-commission revenue allocated to the MA product 2015 2016 2017 2018 2019 2020 2021 Jan -Apr'22 Cohorts Medicare Advantage Variable Cost and Cash Collection (1) per Medicare Advantage Member Variable Cost First Year Cash Collected Renewal Cash Collected Until Q1 22 Receivables Outstanding as of Q1 22 Va ria bl e C os t To be Collected Breakeven (2) (3)